MN DoR M1 2023-2024 free printable template

Get, Create, Make and Sign

How to edit minnesota m1 instructions online

MN DoR M1 Form Versions

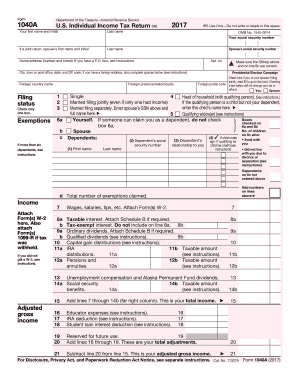

How to fill out minnesota m1 instructions 2023-2024

How to fill out minnesota form m1 instructions

Who needs minnesota form m1 instructions?

Video instructions and help with filling out and completing minnesota m1 instructions

Instructions and Help about form m1 tax

It's almost January 31st and if you're a landlord in Minnesota that's a huge deadline for you that's when CRP forms are due hey everybody john stiles here with bridge realty thanks so much for checking out this video every January in Minnesota rental property owners and managers have to give their residents a certificate of rent paid for the previous year's rent it's a pretty straightforward form, but there can be some confusion about it and if you're new to being a landlord it's important that you learn how to fill out this form so that you don't get penalties now if you already know how to fill this form there's still something for you in this video about halfway through I'm going to tell you about a cool online tool that'll help you fill out all of your CRP forms quicker than you can say cash flow is king let's get into it before we begin it's important that you have the rental income for each apartment ready to go in a report and if you happen to use Quickbooks there's a nice report that you can use I made a video on it, you can see it...

Fill m1 income tax : Try Risk Free

People Also Ask about minnesota m1 instructions

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

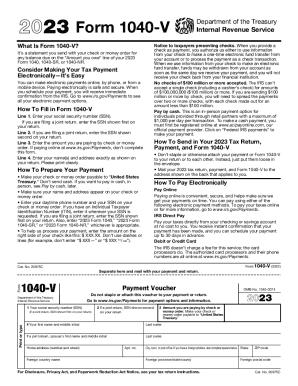

Fill out your minnesota m1 instructions 2023-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.